By VINCE KURAITIS, EDWARD G. ANDERSON, and GEOFFREY PARKER

The COVID-19 pandemic has accelerated calls for the development of EHR 2.0 (electronic health record 2.0) – the next generation of EHRs with extended platform features and capabilities.

Who will answer this call? While existing EHR vendors have made modest efforts, the door is open for big tech companies and start-ups to develop functionality to envelop and disintermediate current EHRs. We highlight early efforts by Google Health Care Studio, an initiative that has been underway for several years but was only formally named in February 2021. We view Care Studio as having the potential to bring platform functionality to a sector of the healthcare industry known for resistance to change and innovation.

We coin a new term – “EHR Envelopment” to describe novel EHR platform capabilities under development by third parties. By “envelopment,” we mean the entry by one platform provider into another provider’s market by adding functionality and exploiting overlapping user bases. New EHR capabilities threaten to dislodge existing EHRs, e.g. through 1) new user interfaces (UIs) that sit above the current EHR, and/or 2) a focus on new value created by integrating, analyzing, and presenting disparate sources of data.

Through the lens of platform strategy, we focus on the impact that EHR Envelopment initiatives could have on the market for electronic health records for large integrated delivery systems. This market has been dominated by a few vendors for decades, but EHR Envelopment projects have the potential to disrupt EHR market dynamics.

The remaining sections of this essay will address:

- The Current EHR Market for Health Systems: Ossified

- Google’s “Care Studio” — What is It?

- Disrupting and Platformizing the EHR Market

- Challenges for Google Health

The Current Market for Health System EHRs: Ossified

The U.S. hospital EHR market has been highly concentrated; in 2020 two firms were dominant, with Epic controlling 29% and Cerner 26% of overall market share.

The EHR market for large health systems is even more highly concentrated. Among large hospitals (with 500+ beds), they collectively control 85% of the market, with Epic owning 58% market share and Cerner 27%.

Today’s EHRs are criticized on a number of fronts: errors and safety issues, cost, lack of competition, lack of interoperability, and lack of usability for clinicians. COVID-19 has highlighted many of the weaknesses in EHRs as being “large, slow monoliths that don’t quickly adapt to new, emergent demands on their design and workflow.”

COVID-19 also is accelerating many trends that already have slowly been transforming the healthcare industry. Andreesen Horowitz venture capitalist Julie Yoo listed six “tectonic shifts bringing about major changes in care delivery,” including “a push toward greater interoperability of data”.

For over a decade we’ve been reading about the need for EHR 2.0. This next generation of EHR capabilities bring platform features such as: vendors with a mindset of orchestrating vs. controlling; a fertile ecosystem of 3rd party apps; and a focus on value creation through seamless data interoperability.

A recent article in Harvard Business Review painted a vision of desired platform-like features for future EHRs. For example, EHRs need to move from simply being “transaction oriented to intelligence oriented;” they must also migrate from a “record to a plan.”

Google’s “Care Studio” — What is it?

Alphabet (more widely known as Google), is one of the largest cloud services technology companies. It has a substantial and increasing presence in healthcare and represents an example of how technology firms can enter the healthcare market. An analysis in Beckers Hospital Review, found that “7% of its searches are health-related” and that Google investments include “57 digital health startups in its portfolio.” Google Health is a new product area, employing over 500 people.

A centerpiece of Google Health’s initiatives is “Care Studio” — its EHR search and related capabilities enabled through artificial intelligence (AI), machine learning (ML), and companion technologies.

Perhaps the simplest way to think about Care Studio is as Google bringing some of its existing capabilities — e.g., search, artificial intelligence (AI), machine learning (ML) — to health care records and data. Dr. David Feinberg — the head of Google Health — capsulized their objectives: “Google has spent two decades on similar problems for consumers, building products such as Search, Translate and Gmail, and we believe we can adapt our technology to help.”

Care Studio capabilities were described in a February 2021 Google blog post by Paul Muret, VP, Product & Design. As we read about these capabilities, we found ourselves asking “Isn’t this what you would expect an EHR to do?”:

- provides a comprehensive view of a patient’s records

- allows clinicians to quickly search through complex patient information

- streamlines workflows and supports more proactive care

- brings together patient records from the multiple EHRs an organization uses

- [gives] clinicians a centralized view of patient data and the ability to search across these records

- harmonizes medical data across different systems

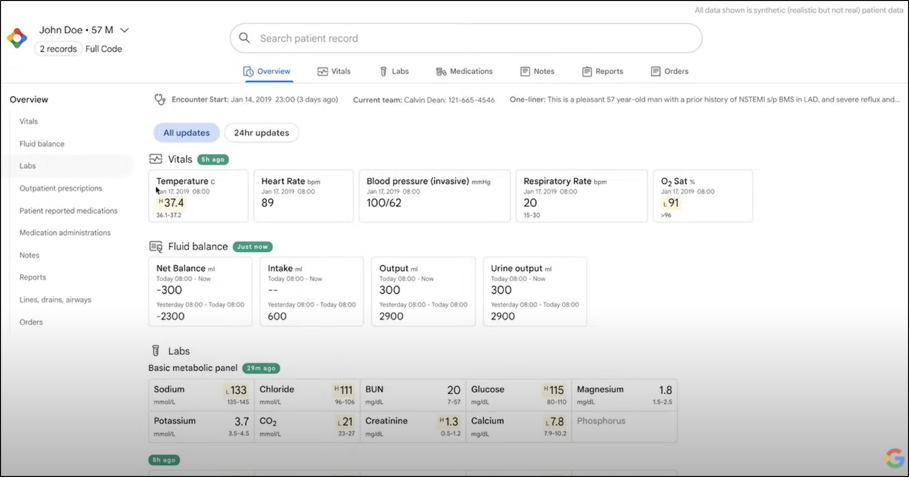

Here’s a screen shot from a Care Studio video. It displays medical record data compiled in an “Overview” tab:

Clinicians will receive real time recommendations to guide diagnostic and treatment decisions for individual patients.

Care Studio initially was developed under the internal name of Project Nightingale, a cooperative project between Google Health and Ascension Health System. Ascension is one of the nation’s largest health systems with hospitals in 21 states.

Disrupting & Platformizing the EHR Market

Does an initiative like Care Studio have the potential to disrupt and platformize the EHR market? We believe the potential is dramatic but the timeframe of analysis is critical.

Short-term: Not Much Impact

While they have the potential for significant disruption and innovation, EHR Envelopment schemes are still under development and unproven. In the near-term, we predict that initiatives like Care Studio will function more as a complement to existing EHRs, not a substitute. Current EHRs serve as a database for health records — and Google’s initial efforts do not attempt to take over that role.

Large health systems make EHR purchase decisions that are expected to play out over a decade or longer. Thus, in the short-term it is unlikely that any EHR Envelopment initiative will shift EHR market share.

Longer-term: Potential to Commoditize EHRs

The long-term implications of EHR Envelopment efforts are much more interesting, although speculative at this time.

Care Studio essentially will sit “on top” of existing EHRs. One of the biggest unknowns is the potential to become a primary UI for at least part of clinicians’ workflows. The greater its ability to become integrated into clinician workflow, the greater the potential for disruption.

We don’t know how Google Health will price Care Studio, or whether it will charge anything at all. Dr. Feinberg has said he operates on a personal directive from Mr. Schmidt: “Don’t worry about making money.” Such pricing dynamics would be consistent with the way that platforms operate in many markets where, at launch, they offer a number of services at zero price, often with the goal of amassing a large userbase before attempting to monetize that user base.

In any event, EHR Envelopment initiatives are likely to put severe pricing pressure on existing EHRs. There is potential to commoditize existing EHRs — at the extreme current EHRs could be relegated to becoming data repositories.

Pressure for Existing EHRs to Become Even More Platform Like

EHR vendors have developed some platform-like capabilities but have faced a steep learning curve in working fluidly with industry partners. It is relatively common for firms that long controlled their vendor relationships to face challenges when attempting to work with ecosystem partners in a more open manner. Nonetheless, we predict that EHR vendors will feel pressured to allow more 3rd party apps to complement their base EHR as a way to compete with and differentiate from Google Health’s Care Studio.

EHR Envelopment projects will bring EHR 2.0 capabilities to clinicians. While it hasn’t announced plans to do so, Google could supplement Care Studio functionality by allowing 3rd parties to build apps that plug into and complement its functionality.

New Competitive Dynamics

It’s not clear how existing EHR and health IT vendors will view Google Health Care Studio capabilities. Friend or foe? Both?

For example, in January 2020 Epic abruptly announced it would no longer be pursuing integrations with Google Cloud. The reason provided was “insufficient interest among our customers.” Given a broad move toward the adoption of cloud service technologies across many industries, we question this explanation and wonder instead whether this represents Epic’s explicit identification of Google Health as a potential competitor.

Google Health’s Care Studio also has potential to shift market share among existing EHR vendors. For example, will Cerner view a close alliance with Google Health as a way to gain market share from Epic?

Challenges for Google Health

Care Studio faces challenges. Many of these are applicable to the broader EHR and health IT markets, e.g., the lack of a national identifier for patient matching, the need to harmonize patient data across disparate hospital systems, and security concerns. Technology initiatives like Care Studio will also need to address many unique issues:

Public and Legislative Scrutiny

Google Health’s efforts became controversial late in 2019. The Wall Street Journal broke an investigative article entitled “Google’s ‘Project Nightingale’ Gathers Personal Health Data on Millions of Americans.” The article revealed that Google’s deal with Ascension gave it access to personally identifiable patient information on millions of Ascension’s patients.

A range of repercussions followed for Google and Ascension: fallout in the press and from privacy advocates; scolding statements expressing privacy concerns from at least four members of Congress; an investigation by the federal Health and Human Services Office of Civil Rights regarding possible HIPAA violations.

The latest Congressional salvo was fired in March 2020. Senators were not satisfied with Google’s initial responses to their inquiries and they pressed for more information. Although the controversy has not made headlines since the onset of COVID-19, it is not yet over.

Patient Trust

In the long run, we believe that successful market entry by technology firms such as Google will require them to work to gain and maintain trust from patients. Along these lines, in April 2020 Google Health announced an initiative to help patients organize and view their health records.

A recent study by Rock Health found that only 11% of respondents would be willing to share their data with a technology company. This becomes increasingly important as COVID-19 has educated patients about the potential for tech to become an integral aspect of their health and care, e.g., through virtual visits.

Clinician Buy-In and Workflow Integration

Google has many product offerings but it is not known for the user-friendliness of its interfaces. There are many aspects of Care Studio that won’t be evident until they are tested in the broader market. For example, will the offering fit into clinicians’ daily workflow? Will clinicians use these new capabilities and features, or will they bypass them? TBD.

Regulatory Issues

Google is used to operating in a market environment that is lightly regulated; health care is an industry that has been heavily regulated. One recent example is the new regulatory landscape of the 21st Century Cures Act and the hundreds of pages of rules that need to be navigated.

Offerings from Other Big Tech Companies

Although we have highlighted Google’s Care Studio to provide a specific example, it is not the only offering aimed at EHRs coming from technology companies. We note that most or all of the major technology companies are developing healthcare offerings and we should expect to see a range of strategies. For example, Apple has taken a more consumer-focused approach toward addressing EHR challenges.

Conclusion

The era of ossified EHRs is likely coming to an end. EHRs originated as software to be installed on client’s servers. While they’ve mostly made the transition to the cloud – there’s one huge step yet to be completed — the pipe to platform transition. We see signs that EHRs are finally being reimagined as platforms. As a result, we would expect to see ripples if not outright disruption throughout the industry as firms jockey to maintain or gain access to users in order to bring their solutions to market, thereby significantly increasing the rate of innovation.

Vince Kuraitis, JD/MBA is Principal and founder of Better Health Technologies, LLC.

Edward G. Anderson Jr., Ph.D is the Mr. and Mrs. William Wright Jr. Centennial Professor for Innovative Technology at the University of Texas McCombs School of Business.

Geoffrey G. Parker, Ph.D. is Professor of Engineering at Dartmouth College and a Fellow at the MIT Initiative on the Digital Economy.

Spread the love